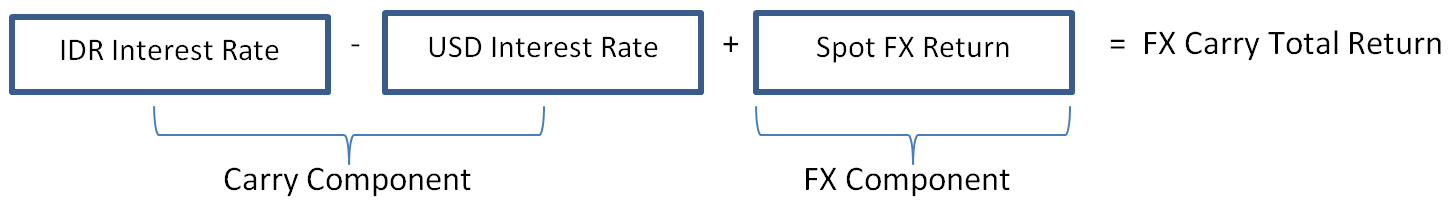

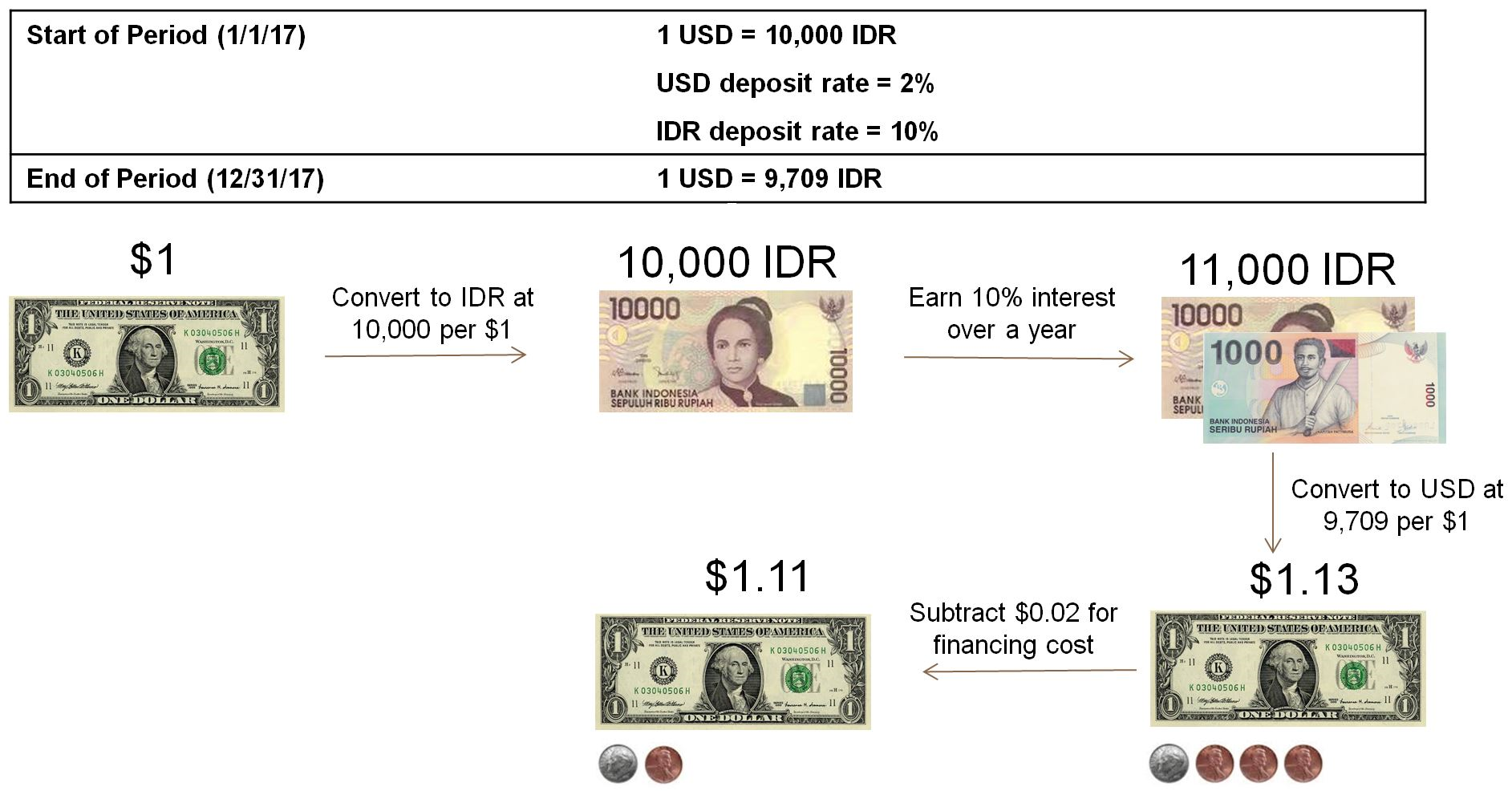

In the absence of changes in the level of the exchange rate investors will receive the yield. Carry trade is a strategy in which an investor borrows or sells a financial instrument with low interest rate and uses the proceeds to lend or purchase a financial instrument with high interest rates.

Forex Home Investopedia

Forex Home Investopedia

Therefore that money must come from shorting another currency.

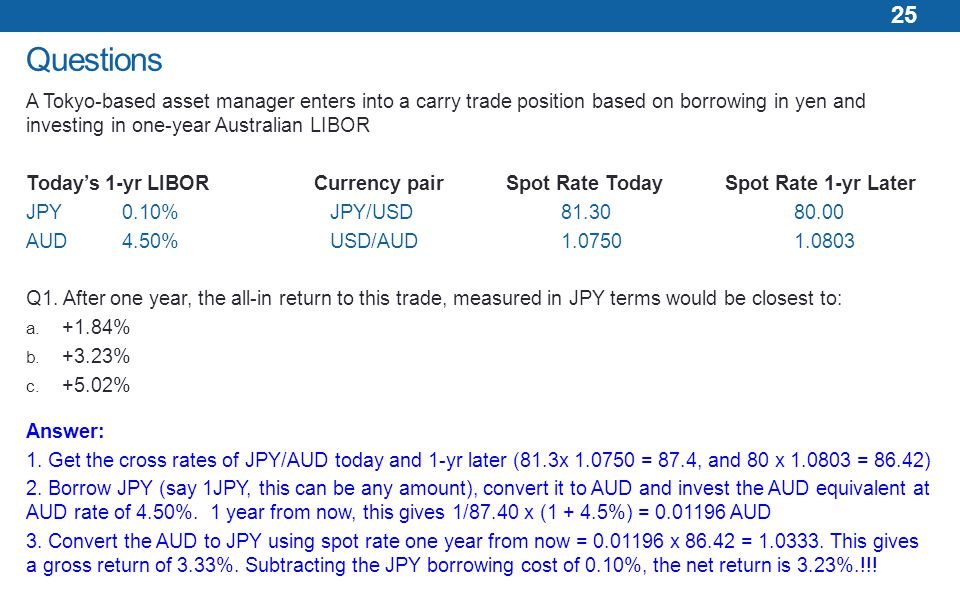

Fx carry trade cfa level 2. Im a little confused on how the cfai books describe and calc fx carry trades. 2 financeasia forex guide 2008! fx carry made easier and safer an introduction to the fx carry trade an fx carry trade takes place when an investor borrows in a low interest rate currency such as the japanese yen and invests in a high interest rate currency such as the new zealand dollar. Reading 14 page 525 example 8 question 5 and page 570 question 3.

On the blue box example on page 525 question 5 they ask for the return in jpy terms. Your beginning nav is exchanged at the. Hi guys maybe someone can shed light on the below.

Section 2 reviews the basic concepts of the foreign exchange market covered in the cfa level i curriculum readings and expands this previous coverage to incorporate more material on bidoffer spreads. For more videos notes practice questions mock exams and more visit. A carry trade requires you to carry a currency.

Level 2 carry trade submitted 2. Carry is long one currency short the other. While the current level of t! he interest rate.

You borrow money and p! ay the foreign rate on the borrowing. This is an excerpt from the ift level ii economics lecture on currency exchange rates. Reme cfa 2 points 3 points 4 points 1 year ago its not a dumb question.

For it to be arbitrage you cannot use your own money. You invest that money at the domestic rate. In canada because carry trade is a speculative activity it is considered other income and therefore taxed at the full marginal rate just like interest.

An effective carry trade strategy does not simply involve going long a currency with the highest yield and shorting a currency with the lowest yield. Here we cover the carry trade strategy. Invest in high yield currency and borrow in low yield if higher yield currency does not depreciate by the interest rate differential profit.

In question 5 page 525 the reciprocal of current spot rate is taken while in question 3 page 570 the reciprocal of the future spot is taken. Con! cept of fx carry trade seeks to profit from failure of uncovered interest rate parity in the short run.

Another Cfa Exam Is Finished Muskblog

:max_bytes(150000):strip_icc()/midsection-of-woman-reading-book-while-sitting-at-table-1049862354-002e0b7b29bc430c841feac11f655cf5.jpg) What To Expect On The Cfa Level Ii Exam

What To Expect On The Cfa Level Ii Exam

Economics Level Ii Cfa Program

Economics Level Ii Cfa Program

Level Ii Cfa The Carry Trade Demystified Youtube

Level Ii Cfa The Carry Trade Demystified Youtube

Currency Exchange Rates Forecasting

Currency Exchange Rates Forecasting

Investing For Income Can Currency Carry Trades Replace Evaporating

Investing For Income Can Currency Carry Trades Replace Evaporating

Basics Of Fx Carry Seeking Alpha

Basics Of Fx Carry Seeking Alpha

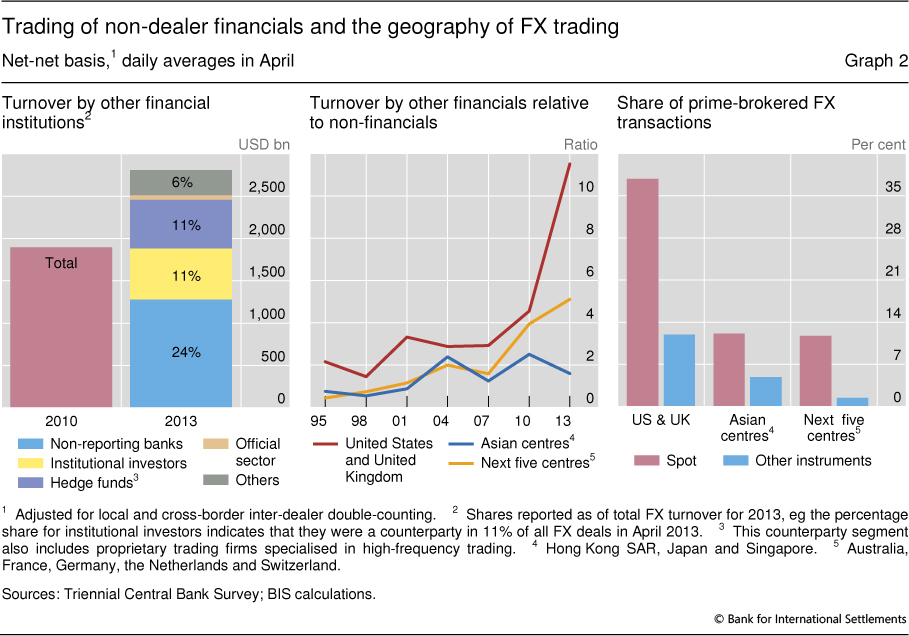

The Anatomy Of The Global Fx Market Through The Lens Of The 2013

The Anatomy Of The Global Fx Market Through The Lens Of The 2013

Cfa Program Curriculum 2019 Level Ii Volumes 1 6 Box Set

Cfa Program Curriculum 2019 Level Ii Volumes 1 6 Box Set

Basics Of Fx Carry Seeking Alpha

Basics Of Fx Carry Seeking Alpha

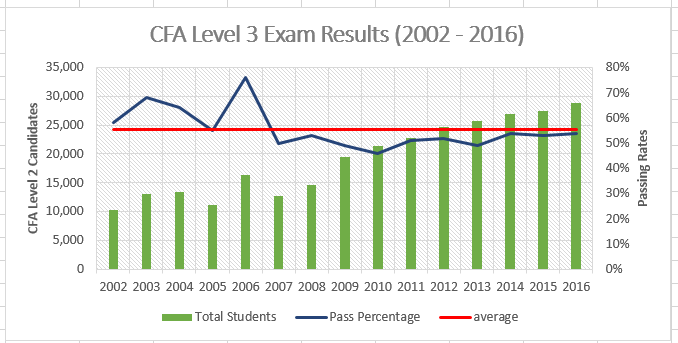

Cfa Level 3 Exam Weights Study Plan Tips Pass Rates Fees

Cfa Level 3 Exam Weights Study Plan Tips Pass Rates Fees

Usd Brandes Institute Carry Trade Analysis

Usd Brandes Institute Carry Trade Analysis

Level Ii Cfa The Carry Trade Demystified

Level Ii Cfa The Carry Trade Demystified

Study Session 4 Economics For Valuation Ppt Download

Study Session 4 Economics For Valuation Ppt Download

Study Session 4 Economics For Valuation Ppt Download

Study Session 4 Economics For Valuation Ppt Download